Dear client or friend of Vailshire Partners LP,

Greetings! After an unusually cool and wet start to the summer, the more normal hot and dry days have returned to Colorado Springs. My family is enjoying the warm days in our new home.

I hope all is well with you.

This quarterly memo will be a bit shorter than normal, as I have started sending out monthly “strategy” emails to all clients (and interested parties) of Vailshire Capital Management. If you do not receive those monthly updates but would like to, please reply to this email and let me know.

The State of Affairs

It seems that there is a new tidbit of geopolitical news trying to excite or worry us every day. But despite the prevailing concerns of tariffs (of not), Brexit (or not), Fed rate cuts (or not), nuclear ambitions, global warming, etc., both the S&P 500 and NASDAQ are near all-time highs. As they say, “Stocks climb a wall of worries.”

For approximately a decade, investors in the stock market have witnessed a remarkably predictable chart pattern of “up and to the right” — which has certainly been beneficial for everyone’s long portfolios. However, as we commence the third quarter of 2019, I am more convinced than ever that we are on the cusp of an earnings recession, and drawing ever nearer to a cyclical economic recession as well.

As I wrote in the last Client Memo, Jerome Powell, Chairman of the Federal Reserve (“the Fed”), has turned from distinctly bearish to a dove-in-waiting. This means that if economic data should look increasingly unfavorable, then the Fed will act quickly to support the US economy via a series of rate cuts, as needed.

However, rate cuts and quantitative easing (QE) policies can only do so much. While they can provide a psychological boost to stock market participants, QE cannot print year-over-year corporate earnings growth or meaningful boosts to US GDP. Which leads us to our current portfolio positions…

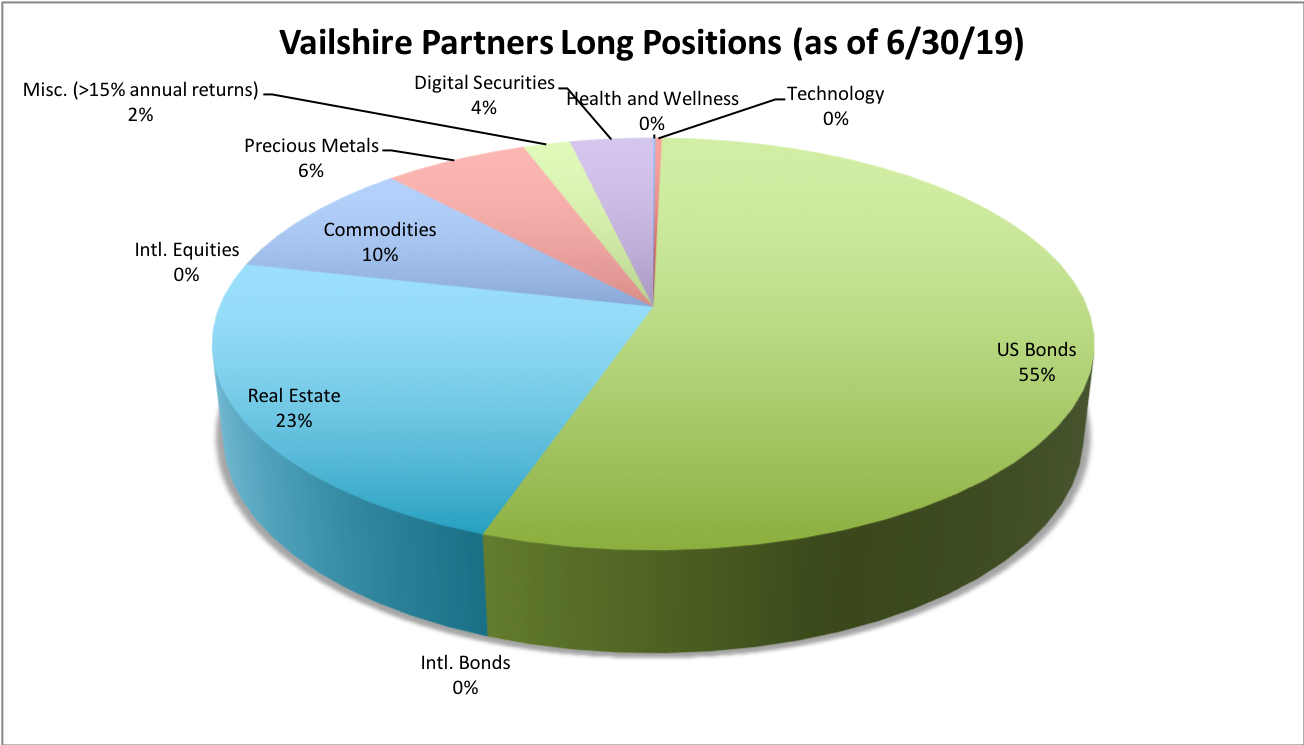

Here are our long holdings within Vailshire Partners, LP, as of June 30, 2019:

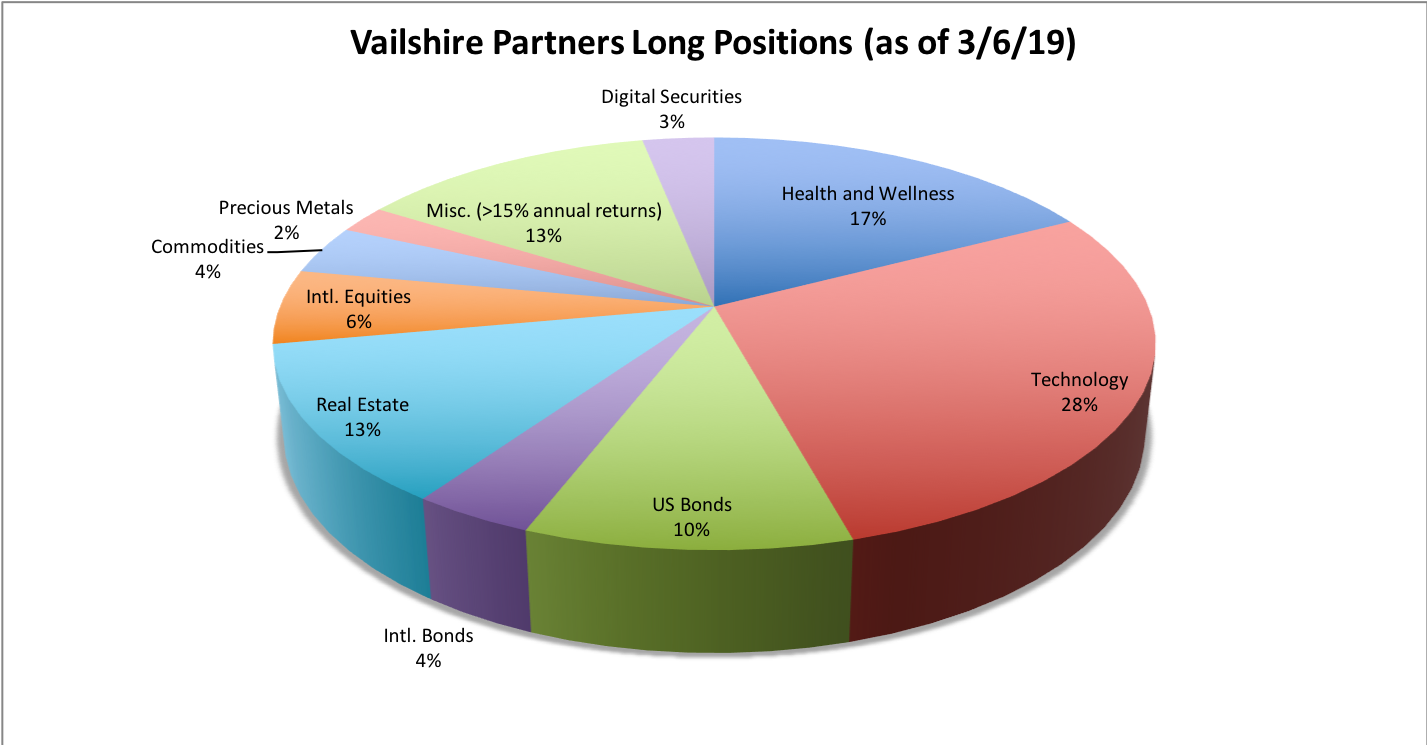

To see how defensive we’ve become since just the previous quarter, here is a flashback to last quarter’s long portfolio holdings:

The first thing that should jump out to you is our very large position in US Bonds; primarily US Treasurys across the yield curve. These holdings have increased from 10% to a whopping 55% of our total long positions… the highest percentage in the history of Vailshire Partners, LP!

Why such a large position in (typically boring) US Treasurys? Because these instruments tend to reduce portfolio volatility and perform remarkably well in periods of decelerating GDP and inflation, which I expect we will see in this quarter of 2019. (To be honest, I missed this similar set-up during Q4 of 2018 and paid the price for it with a poor fund performance. I do not plan on making that mistake again.)

The other thing you may have gleaned from the above comparison pie graphs is that our long Technology positions have decreased from 28% to 0%. This may surprise you if you have been reading my work for any length of time–primarily because I love investing in transformative companies over the long-term. However, when GDP growth and inflation decelerate, and the US (and the world) enters into a recession, it behooves all of us to steer clear of richly-valued, high growth, high volatility stocks… such as the majority of small technology stocks. While such companies generally outperform over the long-term, they get crushed in the short-term–and quickly–when the wrong market conditions are in place.

Not to worry though… I anticipate that we will re-establish positions in such companies in late-2019 or 2020, and resume enjoying their tremendous upside for years and decades to come!

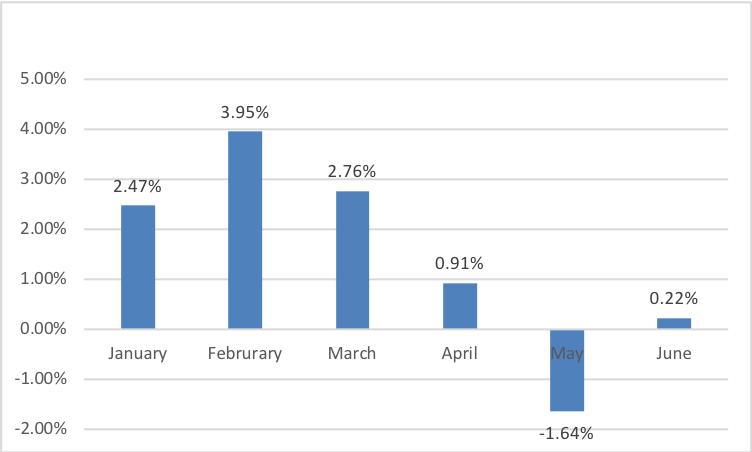

Vailshire Partners, LP – Net Absolute Returns – 2019

As of 6/30/19, Vailshire Partners, LP was Net Long: 70% (94% Long, -24% Short).

In conclusion

It remains an increasingly interesting time to be alive and to be invested! Please know that I take the mandate “To Grow and Protect” your hard-earned savings very seriously. My goal is to generate as much profit as possible for you, regardless of what the stock and bond markets are doing, through a dynamic and thoughtful asset allocation strategy.

As always, if you have any questions or comments, please do not hesitate to reach out directly to me. And if you know of anyone who could benefit from Vailshire’s portfolio management strategies, I would be honored by the referral!

Thanks,

Jeff