Greetings from Colorado Springs!

I hope you and your loved ones enjoyed celebrating the holidays and New Year recently. Our family enjoyed a quiet Christmas together at home before venturing to Minnesota for a quick visit with our family and friends.

The State of the Economy

At the start of a new decade, the US economy remains in a period of decelerating GDP and accelerating inflation. In addition, our manufacturing sector remains mired in a contraction, while CEO pessimism is high.

On the bright side, the services sector barely remains in expansion mode, unemployment is quite low, the US consumer is strong, and–importantly–the Federal Reserve (“the Fed”) continues to inject liquidity into the economy via its infamous “not QE” program.

Geopolitical concerns aside, certain stocks should continue to climb the proverbial “wall of worry” until the next recession occurs. It bears noting that central banks around the world are doing everything in their power to prevent the coming recession, and have so far been successful. Whether or not they continue to prevail remains to be seen!

In the 4th quarter of 2019, our fund gained +2.24%, good for a +5.70% annual return. Read on to see why I expect much more impressive returns for Vailshire Partners LP in 2020.

Looking Ahead: Strategy for 1Q 2020 and Beyond

Given the current stagflationary market conditions–with a decelerating GDP and accelerating inflation–and a dovish Federal Reserve, I remain cautiously optimistic in regards to our equity (stock) exposure. Namely, technology, energy, utility, and housing stocks tend to outperform the broader market during such conditions, with a special emphasis on innovative growth stocks.

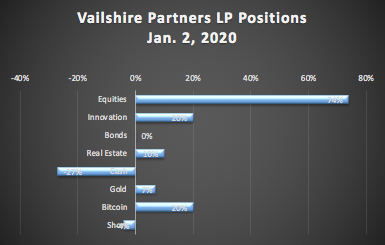

With that framework in mind, here is a schematic of our current portfolio holdings, as of January 2nd, 2020:

Our general equity and “innovation” stock exposure is significantly increased relative to Q4 2019, while our previously large bond allocation has been removed. Bitcoin, gold, and real estate retain prominent positions for the time-being.

As a happy aside, bitcoin (which weighed-down our returns during the final four months of 2019) has returned to form with a vengeance thus far in 2020, and is currently pulling our portfolio forward like a speed boat pulling a water skier! Recall from the last quarterly memo that, despite its volatility, bitcoin has the highest risk-adjusted-returns (Sharpe ratio) of any asset class over the past decade. I expect more of the same in the coming decade… and for us to profit accordingly.

Despite the legitimate concerns about an impending war with Iran, a possible presidential impeachment, and whatever else we read on the front page of the daily newspaper or news website, our portfolio has already gained over 5% in the first five trading days of January… and I am optimistic about impressive future gains over the ensuing months and quarters.

In Conclusion

The economy is a complex and ever-changing organism, but we are well-positioned in Vailshire Partners LP to grow and protect our savings via innovative, systematic, and ever-improving investment strategies. While the future is always uncertain and unpredictable, we are prepared to quickly respond to, and profit from, whatever comes our way.

As always, if you have any questions or comments for me, feel free to reply to this email or give me a call. I sincerely appreciate the trust you have placed in me.

Investing wisely with you,

Jeff