The first quarter of 2019 saw a marked change in the equity and bond markets from the very difficult conditions we faced in the last quarter of 2018. Jerome Powell, head of the United States Federal Reserve (“the Fed”), and his team of central bankers almost single-handedly caused the steep market losses through his/their hawkish comments of “quantitative tightening” (QT) in the summer and fall months.

However, since the beginning of 2019, Powell & Co. abruptly turned dovish–declaring an end to their QT policies of raising the Federal Funds rates and decreasing their bond and mortgage backed securities holdings.

What does this mean?

By converting from QT to hinting at the resumption of quantitative easing (QE) efforts later in 2019, the Fed is basically saying that they will stop their experiment of removing liquidity from the U.S. economy and attempt to maintain healthy and enticing rates of credit. In so doing, they hope to kindle renewed optimism in the business sector, reinvigorate the GDP, and (indirectly?) continue to inflate the stock market.

Some members of the Fed have described a specific plan in their upcoming QE efforts; that is, to purchase huge amounts of short-term U.S. Treasurys, while not buying any intermediate or long-dated counterparts. Though I have not heard them admit this outright, I believe their strategy to be a very intentional effort to reverse the flattening of the yield curve.

A flattened yield curve simply means that short term interest rates have become greater than or equal to long term interest rates. This is considered abnormal–you should expect to receive a higher interest rate if you loan money to someone for a longer period of time, no?–and often portends to a coming economic recession… which is almost uniformly bad for stock and bond holders.

Why is this relevant to us as investors?

Many economic indicators–not the least of which is the recently flattened yield curve–suggest that a recession lies just around the corner for the United States. Among other major world economies, Italy is already in a recession while Germany is on the brink. Given the declining rates of global economic growth, the world’s central bankers are once again banding together, first in rhetoric, then in action, to unleash ever more rounds of QE.

As I see it, the Fed and other central bankers are going toe-to-toe with their respective country’s business cycle (which is threatening to fall into recession) via increased liquidity and lower borrowing rates. Either businesses will bite and the economies will revive, or the QE efforts will be futile, global growth will slow, and economies will get knocked-out by the impending cyclical recession.

If the Fed’s plan works, then the “risk on” trade will return with a vengeance, likely causing the following sectors to perform well:

- Cloud, software as a service (SaaS), 5G-related, AI, and many other disruptive technology stocks

- Healthtech and wellness equities

- Short term Treasurys

- Cryptocurrencies and newer digital securities

- Chinese equites (depending on US/China trade agreement)

However, if the Fed’s plan proves to be futile, then a recession will come sooner-than-later, and the safest “investments” will be cash, gold, and shorting (betting against) stocks, among others.

What is our current strategy within the hedge fund?

I strongly believe that money always flows to where it is best treated. And in order to achieve outsized investment or speculation profits, one must follow the waves of liquidity. Legendary hedge fund manager Stanley Druckenmiller follows a similar top-down strategy, and has been immensely successful throughout his storied career.

While I have never been in the prediction business, I believe that it is very worthwhile to watch and listen intently to the Federal Reserve as they describe their monetary policy intentions. The market is forward looking, and so am I.

The Fed has strongly hinted at reversing its QT policies of 2018 and implementing new QE policies in the latter half of 2019. Not to be trifled with, the Fed has become quite formidable over the decades and I think that these policies will work for the near-term; and so we are positioned accordingly (more aggressively) within our fund.

However, at some point in the coming 1-3 years, I expect the enormous “easy money” debt burdens and low interest rates to finally hamper businesses–and then, the overall economy–and ultimately lead us into a recession of epic proportions. As the tell-tale signs arrive, our positions will become increasingly defensive.

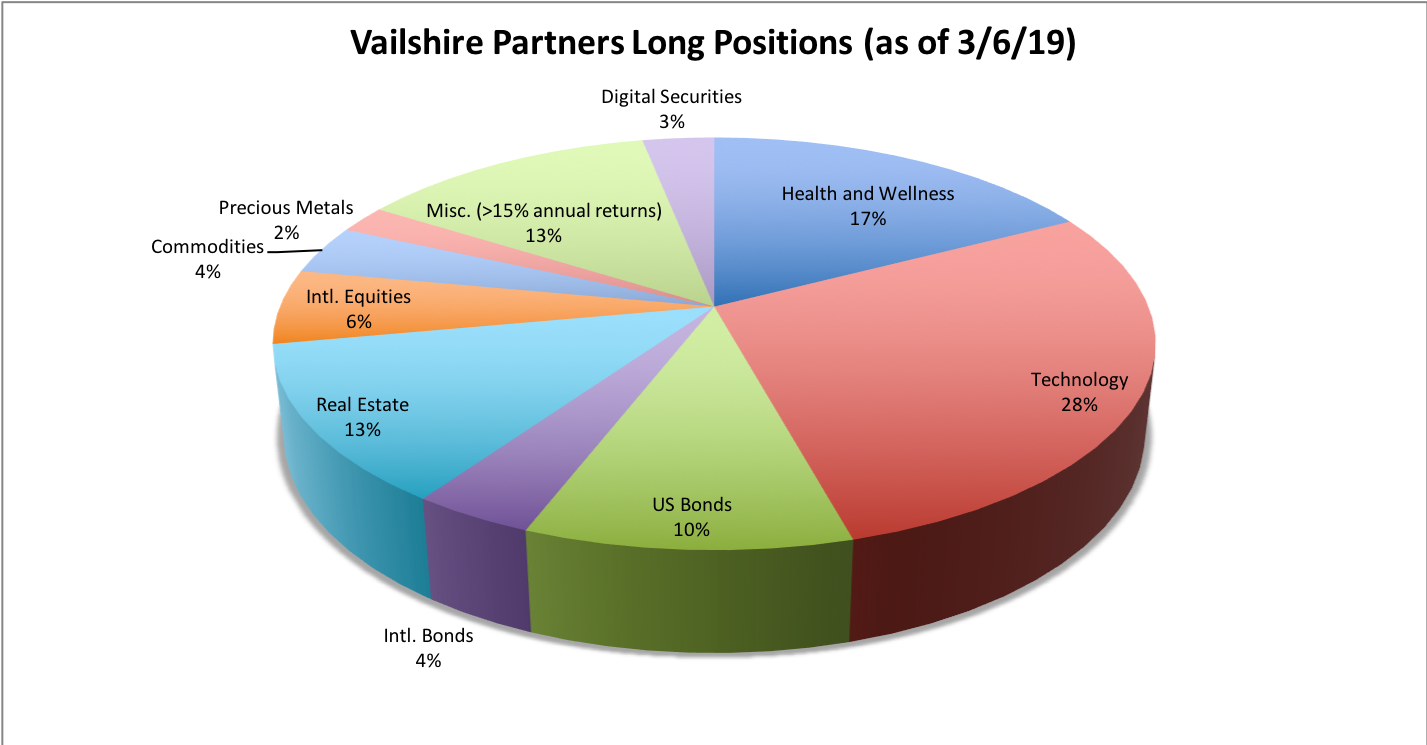

What are our current positions within the hedge fund?

I expect our more aggressive positions to continue to outperform over the next few quarters as expectations for QE take hold. I anticipate it to be similar in scope to the dot-com mania of the late 1990s.

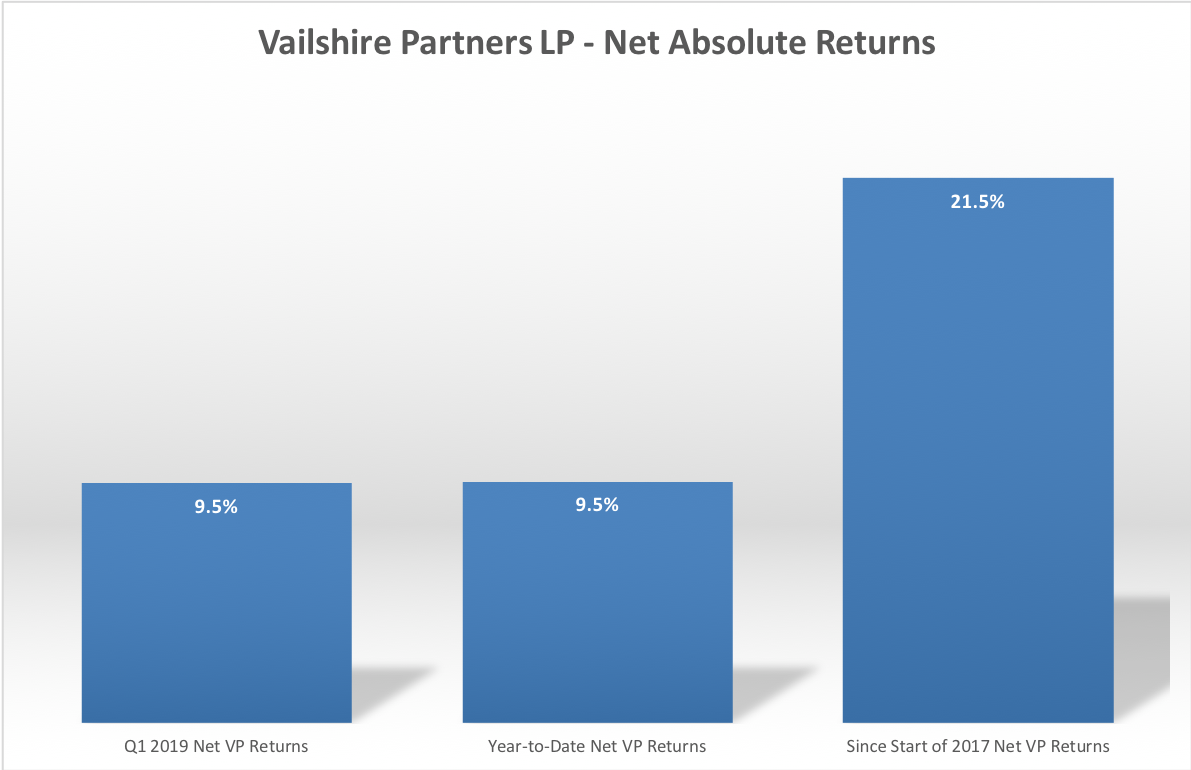

Net results of Vailshire Partners LP*

(*in 2019 and since implementing our “Grow and Protect” systematic portfolio strategy at the beginning of 2017)

In conclusion

It is an extremely interesting time to be alive and to be invested! Please know that I take the mandate “To Grow and Protect” your hard-earned savings very seriously. My goal is to generate as much profit as possible for you, regardless of what the stock and bond markets are doing.

As always, if you have any questions or comments, please do not hesitate to reach out directly to me.

Thanks,

Jeff

p.s. In case you missed it, I was recently honored to be interview by the living-legend value investor, Dan Ferris, on the Stansberry Investor Hour podcast. If you are willing, use this link to listen.