To SMA clients and friends of Vailshire Capital Management:

- Another bank bites the dust (RIP First Republic)

- The Federal Reserve has its hands full in keeping the financial markets calm

- Despite reaching near-term overbought levels, sound money is making a comeback

Current Market Conditions

Sticky High Inflation and a Sticky Hawkish Fed

Greetings from Colorado Springs!

This weekend marks the failure of another sizable US bank.

First Republic Bank was flying high throughout the 2010s and reached its zenith in late 2021… catering to high net worth individuals and tons of innovative and entrepreneurial companies of the Silicon Valley ilk. These companies uniformly thrived during the zero interest rate policy (“ZIRP”) era and banks servicing their needs could do no wrong.

However, the Federal Reserve’s controversial rapid hiking of the federal funds rate in 2022-23 created a duration mismatch for some financial institutions that borrowed short and lent long without hedging against such risks. As bank customers began to realize that First Republic was particularly weak and vulnerable, they fled… quickly… along with their substantial deposit base.

Banks without depositors are no banks at all, which is why the FDIC is currently looking for an emergency buyer of First Republic Bank as I type this update. And once again, the Federal Reserve will have its hands full in calming the financial markets during the coming days and weeks–even though it is their very own policies that perpetually inflate our massive asset bubbles and cause subsequent recessionary calamities.

The irony is palpable. And tragic.

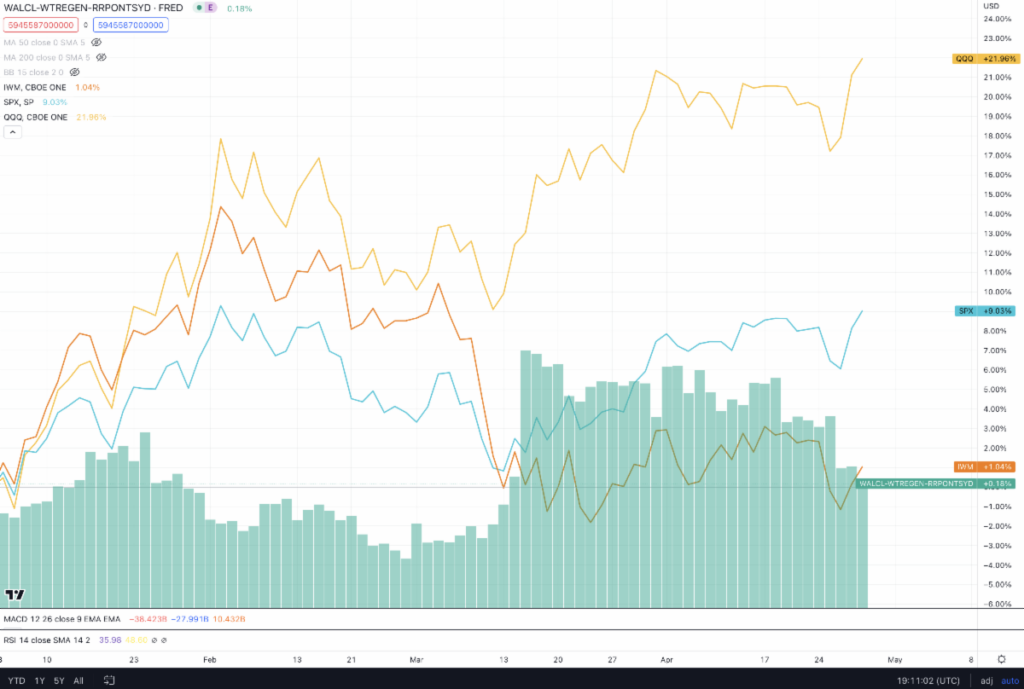

Risk assets performed well enough in April although they are starting to show (unhealthy) signs of divergence. Net liquidity in the US peaked in mid-March and has since been trending strongly downwards. US small cap stocks, oil, and copper–among others–took the hint and have started or remained in bearish downtrends. Technology and other more volatile stocks have yet to take their appropriate cues and have performed quite well as of late.

The graph below depicts US Net Liquidity (green bars) year-to-date, compared with US small cap stocks (IWM), the S&P 500 (SPX), and NASDAQ stocks (QQQ). Note the near 1:1 correlation (with a slight delay) between net liquidity and US small cap stocks. NASDAQ and, to a lesser extend, S&P 500 stocks continue to soar despite the declining liquidity since 15-March-2023.

Strategies for Vailshire’s SMAs

We continue to hold a sizable allocation of US-based high free cash flow yield ETFs spanning both the large and small cap sectors. As I have previously written, I believe that these equities stand the best chance of longer-term outperformance during this (expected) decade of stagflation.

In April, we made the switch from an emerging market stock ETF to a wider ranging international stock ETF (which includes many of the best emerging market companies as well). This increases our diversification going forward and maintains sizable non-US equity exposure within our portfolios.

NASDAQ stocks will also be added (via QQQ) as the ETF reaches oversold levels in the near-term. At the moment, I believe such stocks to be at temporary overbought levels… meaning that they appear due for a material drawdown in the coming days and weeks.

Because Vailshire’s trading system is showing short-term overbought levels in many of our typical asset holdings, we have trimmed positions and/or added short positions to protect and (hopefully) profit from anticipated drawdowns in the coming days and weeks.

Regarding the “sound money” exposure in Vailshire portfolios, we are intermittently adding to our cash, gold proxy, and bitcoin proxy allocations as prices demonstrate solid long term bullish momentum and have become oversold in the near term. Hopefully we will get lower prices during the coming weeks and months to maximize our gold- and bitcoin-proxy position sizes.

Here is a summary of our current Vailshire portfolio allocations:

Vailshire’s Conservative and Ultra Conservative separately managed accounts (SMAs) are long-only and are allocated as follows–current (max) base % position size:

- 30% (max 30%) LONG large and small cap US equities with high free cash flow yields

- 3.75% (15%) LONG international equities

- 0-1.25% (5-10%) LONG Bitcoin proxies

- 5% (20%) LONG gold proxies

- 60-61.25% cash

Depending on your financial objectives and individual account investment privileges at IB, Vailshire’s Aggressive and Moderate SMAs are allocated as follows:

- 30% (max 30%) LONG large and small cap US equities with high free cash flow yields

- 3.75% (15%) LONG international equities

- 3.75-6.25% (15-25%) LONG Bitcoin proxies

- 2.5-3.75% (10-15%) LONG gold proxies

- 7.5-11.25% (hedge) inverse NASDAQ ETF

- 5-7.5% (hedge) inverse US small cap ETF

- 5-7.5% (hedge) inverse S&P 500 ETF

- 5-7.5% (hedge) SHORT bitcoin futures ETF

- 20-33% cash

Note that these position sizes are dynamic and may change over the coming days and weeks as oversold and overbought conditions arise.

If you are a Vailshire client, feel free to log in to your account(s) at Interactive Brokers and see how your own portfolios are positioned. (It’s a good idea to log in and review your account(s) at least quarterly, just to make sure your settings and demographics are up to date.)

Conclusion

Sound Money is Making a Comeback!

Graph (above): Although short-term momentum is waning and it is coming off of recent overbought highs, gold priced in US dollars has maintained a strong new bullish uptrend since bottoming in 4Q 2022. Bitcoin’s price action (not shown) has been even more impressive!

Many of our our equity and sound money portfolio positions continued their upward price action over the past month. However, many of these assets have reached relatively overbought levels and appear due for a pullback in the coming days and weeks. Given this, we have taken some profits, added some hedges (where appropriate), and have increased our cash positions.

Ideally, our patience will pay off and we will be given the opportunity to increase our core positions at lower prices in the not-too-distant future! While we wait, our increased cash positions and hedges should provide protection against drawdowns as US net liquidity continues to contract.

I appreciate the trust you have placed in Vailshire to grow and protect your hard-earned capital. As always, I will strive to continue growing, adapting, and fighting for you and your portfolios each and every day.

Living well and investing wisely with you,

Jeff Ross, MD/MBA