Dear client or friend of Vailshire Partners LP,

Greetings from Colorado Springs!

It is not an exaggeration to say that the world and the economy have changed dramatically since my last quarterly memo.

The State of the Economy

The coronavirus and the disease it causes, COVID-19, needs no introduction. The world’s economy was previously dancing on the precipice of a cyclical recession and the unwelcome pandemic pushed it over the edge.

In the US, our historically low unemployment levels have already skyrocketed to unprecedented heights, leaving 10 million Americans without jobs… and this is just the start. This month (April), we will see a steady flow of shocking statistics of a country whose businesses have been–willingly or unwillingly–ground to a halt.

Increased unemployment means less cash coming in… less saving by individuals and families… and less spending. Consumption–the largest component of our GDP–has drastically receded and many businesses are hanging on by a thread, or are already bankrupt.

We are left with epic deceleration in GDP and deflation, which typically bodes quite poorly for stocks. US stock markets followed the script, with the Dow Jones Industrial Average dropping over 23% in 1Q 2020, and the S&P 500 losing 20%.

The question most serious investors and fund managers are currently debating is: “What type of recovery will our economy experience?”

Will it be a quick down-and-back-up-again “V-shaped” recovery? A down-for-longer period, then a quick reversal (“U-shaped”)? Or a dreaded down indefinitely “L-shaped” non-recovery?

The timing of the economic recovery (or not) will have serious implications for the equities and fixed income markets.

Furthermore, there is a real chance of an economic depression, which would have a serious, long-term impact on our investment decisions and the performance of our portfolio holdings.

For now, everything is simply speculation. I will continue to let my investment decisions within the fund be directed by my research as the underlying economic data become available.

Vailshire Partners LP Quarterly Performance

Jan. 2020: +8.48%

Feb. 2020: +1.40%

Mar. 2020: –14.51%

1Q 2020

Vailshire Partners LP: -5.95%

DJIA: -23%

S&P 500: -20%

While I am not enthusiastic about our fund being down at all thus far in 2020, I am quite pleased about our outperformance of the S&P 500 by approximately 14% and of the Dow by a whopping 17%! In addition, I am optimistic that this outperformance will significantly grow as the year progresses.

Outlook for the Remainder of 2020

Recent bear market bounces aside, even the most optimistic investors will shudder when companies begin reporting their 1Q 2020 results in the coming weeks. And as I mentioned above, the economy will continue reeling from unprecedented deceleration in both GDP and inflation… conditions that are traditionally terrible for most US equities.

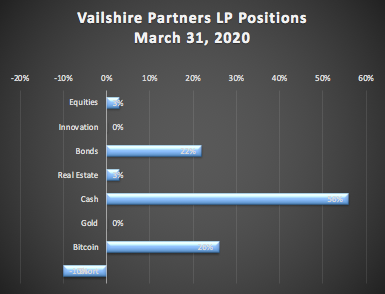

Until I see definitive signs of a relatively quick economic recovery in my research, I will maintain relatively defensive positions within Vailshire Partners LP. As of March 31, 2020, our asset allocation was as follows:

As the 2nd quarter progresses and volatility subsides, I expect that we will decrease our large cash position and increase our US Treasury and gold positions, among others. Later, if economic conditions show signs of improvement, we will return to equities and real estate in earnest.

For now, we will remain defensive and vigilant… and protect what’s ours.

In Conclusion

We are living in tumultuous times. But in every difficult circumstance, the shrewd observer can find opportunity.

Stock market profits are no longer easy to come by. Such is the hand we have been dealt, and Vailshire Partners will continue to maneuver in such a way as to profit from the underlying economic and market conditions.

As always, if you have any questions or comments for me, feel free to reply to this email or give me a call. I am honored by the trust you have placed in me.

Investing wisely with you,

Jeff