To SMA clients and friends of Vailshire Capital Management:

- All eyes are on the debt ceiling debacle

- Net liquidity may contract while the Treasury General Account is replenished

- Risk assets may underperform in the near-term, creating compelling long-term buying opportunities

Current Market Conditions

All Eyes on the Debt Ceiling Debacle

Greetings from Colorado Springs! I hope this monthly investor update finds you well.

If you pay any attention to the news, then you have probably heard by now that the House just passed a bill on the evening of May 31st to (among other things) raise the debt “ceiling.” I put “ceiling” in quotations because–as most of us are well-aware–there is no such thing as fiscal restraint for Congress… but I digress. Ongoing spending and debt compilation will relentlessly occur until the US fiat currency eventually collapses secondary to lack of confidence.

This is the way of fiat things.

I expect the Senate to quickly vote in favor of this bill and send it along to the POTUS, where it will be signed into law.

Once enacted, things will start to get more interesting.

As you know, I keep a close eye on liquidity flows in the United States and across the world’s major economies. While this exercise may seem esoteric to some, there is an extremely high degree of correlation (though not necessarily causation) between liquidity and the performance of risk assets.

Since 2009 or so, if liquidity is generally expanding, then risk assets tend to perform well. Conversely, if liquidity is contracting, then risk assets tend to perform poorly.

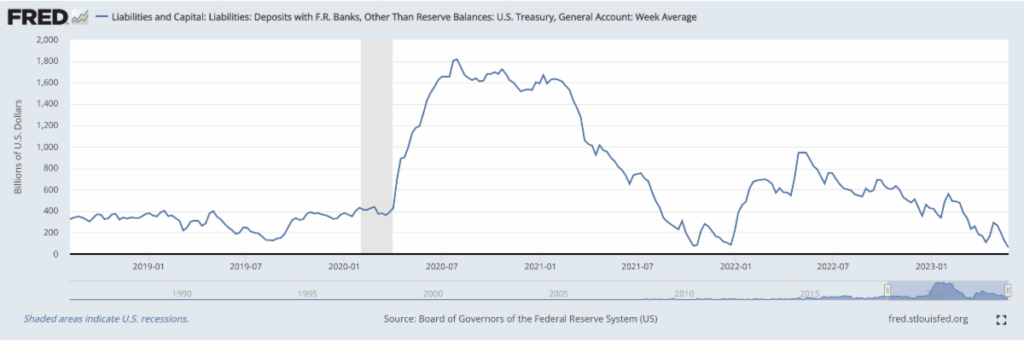

While the Federal Reserve has been busy with quantitative tightening since late 2021, one of the biggest drivers of US liquidity expansion since May of 2022 has been the drawdown of the Treasury General Account (TGA), from approximately $945B to $62B (as of 24-May). It can be argued that a part of the general rise in risk assets over the past 6-9 months has been due, at least in part, to the transfer of liquidity from the government’s coffers to the private sector.

With the imminent raising of the debt “ceiling” the TGA will need to be replenished via the issuance of new T-bills and/or longer-dated Treasurys. Without going much further into the weeds, this refilling of the Treasury’s General Account will entice liquidity to flow out of the private sector and back into the government’s coffers. This net liquidity contraction may potentially lead to a period of underperformance for certain risk assets.

The graph below depicts US Net Liquidity (green bars) since 1-May-2023, compared with Vailshire portfolio holdings of: small cap stocks with high free cash flow (FCF) yields (ticker: CALF), large cap stocks with high FCF yields (COWZ), Franco-Nevada Corp. (FNV), MicroStrategy (MSTR), NVR, Inc. (NVR), Texas Pacific Land Corp. (TPL), Vanguard Total International Stock Index Fund (VXUS), Valkyrie Bitcoin Miners ETF (WGMI), and NASDAQ stocks (QQQ). Note that while net liquidity has expanded by 1.5%, only two of our Vailshire portfolio assets have outperformed (WGMI and QQQ).

Strategies for Vailshire’s SMAs

I continue to be convinced that stagflation (a generally stagnant US economy plus annoyingly persistent and volatile inflation) will be the dominant theme of the 2020s.

As such, we used the month of May to fully implement our long-term “stagflation-busting” asset allocation strategies across Vailshire portfolios.

During the month, we were able to quickly trim (take some profits in) our profitably overbought QQQ position and add to some briefly oversold positions (MSTR and TPL). In our Moderate and Aggressive accounts, small short-term hedges were recently placed against an expected pullback in the currently overbought NASDAQ stocks via ownership of SQQQ.

Here is a summary of our current “stagflation-busting” Vailshire portfolio allocations:

Vailshire’s Conservative and Ultra Conservative separately managed accounts (SMAs) are long-only and are allocated as follows (current base % position size):

- 10% CALF

- 10% COWZ

- 20% FNV

- 5% MSTR

- 10% NVR

- 10% QQQ

- 10% TPL

- 10% VXUS

- 0-5% WGMI

- 10-15% cash

Depending on your financial objectives and individual account investment privileges at IB, Vailshire’s Aggressive and Moderate SMAs are allocated as follows:

- 10% CALF

- 10% COWZ

- 10-15% FNV

- 10-15% MSTR

- 10% NVR

- 10% QQQ

- 10% TPL

- 10% VXUS

- 5-10% WGMI

- 1.25-7.5% cash

- 2.5-3.75% SQQQ (short-term hedge/trade)

Note that these positions may be increased or trimmed as oversold or overbought conditions arise.

**As written in a prior email, clients in CA, FL, MN, and TX remain in cash-only positions as Vailshire awaits state-specific regulatory approval to begin/resume investing on behalf of these client accounts. Approval will hopefully occur in the coming days or weeks.**

If you are a Vailshire client, feel free to log in to your account(s) at Interactive Brokers and see how your own portfolios are positioned. (It’s a good idea to log in and review your account(s) at least quarterly, just to make sure your settings and demographics are up to date.)

Conclusion

Buckle Up for What’s Next

Graph (above): As discussed above, the Treasury General Account is getting quite low and needs to be refilled with $500B or more in June 2023. What will the effects be on net liquidity and risk assets as this occurs over the coming weeks?

The story over the coming weeks and months will be how risk assets respond to a potential contraction of US net liquidity. While our Vailshire portfolios are well-positioned for the anticipated stagflationary 2020s, short-term jolts in the economy and markets may offer up enticing opportunities for us to add to existing positions and lower our cost basis.

If we remain focused on the long-term and prepare for various potential outcomes, we can calmly and methodically take advantage of any short-term opportunities that may present themselves to us.

As always, I am honored and humbled by the trust you have placed in me and in Vailshire to manage your hard-earned assets over the coming years and decades.

Living well and investing wisely with you,

Jeff Ross, MD/MBA