Dear Client of Vailshire Partners LP,

Despite the incessant geopolitical turmoil, 2020 was a remarkably good year for Vailshire’s hedge fund investors! — Read on to learn more about our recent results, as well as our outlook for the coming quarters.

Current Market Conditions

Alternative Assets and Outsized Returns

For myriad reasons, 2020 was a year that will live in infamy.

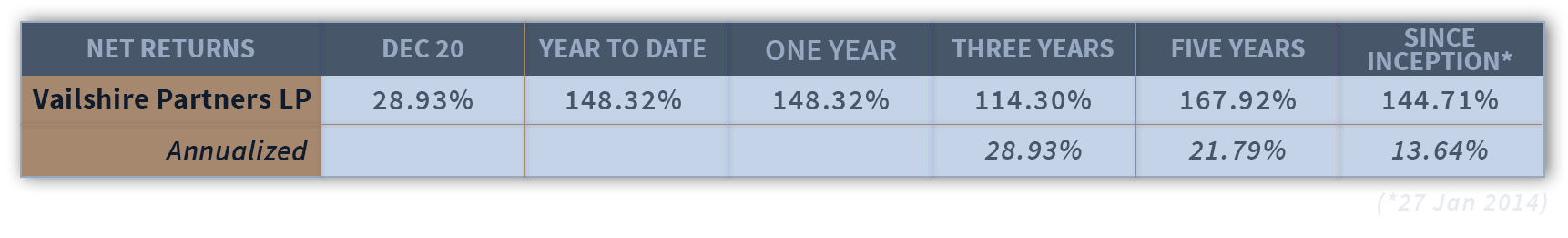

Despite the difficult market conditions, Vailshire Partners LP — our innovative, long/short, healthcare and technology-centered hedge fund–delivered market-crushing net returns for its clients of 148%. It is almost nonsensical to compare our fund’s performance with the 18% total return of the S&P 500… a difference of 130%!

As I wrote in late 2019, traditional 60/40 stock and bond portfolios simply won’t cut it during this new decade. In general, valuations of both US equities and bonds are extremely stretched, which practically guarantee poor real returns in these retirement account staples over the next 10-12 years.

Thankfully, Vailshire Partners’ innovative, full-cycle investment approach relentlessly evaluates assets across the world, including stocks, bonds, currencies, commodities, real estate investment trusts, Bitcoin, and other cryptocurrencies. Allocating to the right asset classes at the right time makes a huge difference in long-term performance.

The ability to take long or short positions in almost any asset class, coupled with real-time economic and inflation indicators, led to significant alpha generation for Vailshire Partners LP throughout 2020 (see table).

Underlying ongoing fearful political and economic headlines is a hint of optimism among consumers and business owners. Both in the United States and across the world, economies are once again reviving and rebounding following the coronavirus pandemic.

Underlying ongoing fearful political and economic headlines is a hint of optimism among consumers and business owners. Both in the United States and across the world, economies are once again reviving and rebounding following the coronavirus pandemic.

Gross domestic product (GDP) and inflation are both accelerating in 1Q2021, and these numbers will improve even more dramatically in the 2nd quarter. These facts, coupled with very low interest rates and astonishing amounts of Federal Reserve “support” via unprecedented money printing should:

- Flood the economy with US dollars

- Significantly weaken the US dollar

- Inflate asset prices across the board

In short, this is an opportune time to aggressively trade our rapidly depreciating cash in the bank for rapidly appreciating hard assets, such as innovative businesses, commodities, Bitcoin, emerging market equities, and more.

2021 Investment Plan

Off to the Races!

Given the positive underlying market conditions, we are positioned quite aggressively for profits in the coming months.

Our strategic portfolio is currently comprised of disruptive technologies, long-term value creators, and founder-led businesses across the high-growth technology and healthcare sectors… investments that are truly shaping the world in profound and beneficial ways.

As the economy picks up steam and moves from bad to less bad to downright optimistic over the coming months, we will be fully invested and generating alpha along the way.

Thanks for your continued confidence and trust in Vailshire Partners LP. As founder and portfolio manager, I am extremely honored and humbled by your partnership!

If you are an accredited investor and would like to discuss what Vailshire’s innovative, full-cycle investment strategies can do for you, please do not hesitate to reach out to me personally. There has never been a better time to be invested with us!

Living Well and Investing Wisely with you,

Jeff Ross, MD, MBA