Dear client of Vailshire Partners LP hedge fund,

2021 is off to a great start for clients of Vailshire Partners! — Continue reading to learn more about our recent results, as well as our outlook for the remainder of 2021.

Alternative Assets and Outsized Returns

After an eventful, anxiety-filled, and downright depressing 2020, the new year (2021) is off to a much better start!

While the psyche of market participants is slowly changing from scared to mildly optimistic, we have been positioned for optimistic returns across several important asset classes for two full quarters… and this conviction has rewarded us handsomely.

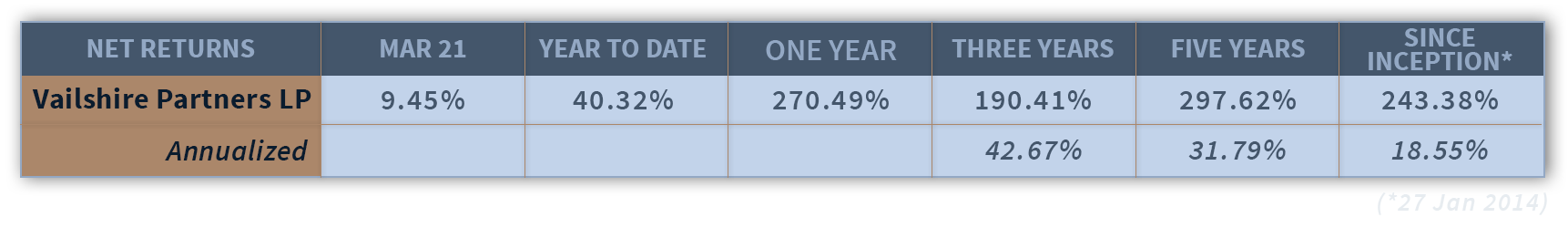

Over the trailing 12 months, Vailshire Partners LP–our innovative, long/short, healthcare and technology-centered hedge fund–delivered market-crushing net returns for its clients of 270%. We are clearly in the sweet spot of alpha generation, since our fund outpaced the S&P 500’s total return (of 54%) by a whopping 216%!

I don’t share these statistics to brag but, rather, to point out the fact that alternative assets often can and do provide significantly outsized returns as compared to the traditional 60/40 stock and bond portfolio. As I have been writing and speaking about since 2019, I believe that the 2020s will be a very difficult decade for traditional investors–akin to the 1930s and 1970s–and that the ability to invest wisely across non-traditional asset classes will further separate the wheat from the chaff.

Thankfully, Vailshire Partners’ innovative, full-cycle investment approach continuously evaluates myriad assets across the world, including stocks, bonds, currencies, commodities, real estate investment trusts, bitcoin, and other cryptocurrencies. Long-term performance generally favors forward-thinking investors with a comprehensive portfolio management strategy.

As alluded to above, the ability to take long or short positions in almost any asset class, coupled with real-time economic and inflation indicators, has led to significant alpha generation for Vailshire Partners LP over the recent quarter, as well as the past one, three, and five years (see table).

Current Market Conditions

Thanks to rapid vaccine deployment and developing herd immunity in the US and across most of the world, fears of Covid are finally starting to recede. Market participants are beginning to wake up to the fact that there is very real pent-up demand for goods and services as businesses reopen. Stock markets, forward-looking as they are, should move from strength to strength in the ensuing months.

Year-over-year gross domestic product (GDP) and inflation are both rapidly accelerating in 2Q 2021. As I described in last quarter’s memo, these facts, coupled with ongoing low interest rates and astonishing amounts of Federal Reserve “support” via unprecedented money printing should:

- Flood the economy with US dollars,

- Significantly weaken the US dollar, and

- Inflate asset prices across the board

In light of this phenomenon, we will continue to hold aggressive positions within our portfolio while the opportunity to do so remains. We continue to “make hay while the sun shines.”

Rest assured that when the underlying economic and inflation indicators begin to sour, we will likely switch our investment strategies from “highly aggressive” to “cautious,” as warranted. Based on my research, this transition may be required as soon as June or July, but only time (and actual data) will tell.

2Q 2021 Investment Strategy

Off to the Races!

As stated above, given the current very strong underlying market signals, we remain aggressively positioned for profits within our fund.

Strategic positions include disruptive technologies, long-term value creators, and founder-led businesses across multiple sectors. Many of these companies are actively shaping the world for a better tomorrow, which increases my strength of conviction.

Although I obviously can’t predict the future, I am confident in our innovative, full-cycle portfolio management strategies and am hopeful that we will continue our market-outperformance over the coming months.

As Vailshire’s founder and portfolio manager, I remain extremely honored and humbled by those of you who have joined me within the fund to date. I do not take lightly the trust which you have placed in me and Vailshire’s investment strategies.

For current non-clients: If you are an accredited investor and would like to discuss what Vailshire’s innovative investment strategies can do for you and your family, please do not hesitate to reach out to me personally. This is not a solicitation to invest but, rather, an invitation to inquire more.

Living well and investing wisely with you,

Jeff Ross, MD/MBA