To clients and friends of Vailshire Partners LP hedge fund:

- Inflation remains high while US GDP is rolling over

- Given historically high inflation rates, the Federal Reserve is stuck between a rock and a hard place

- Many high quality assets have sold off and are ready to buy

Performance Review

From Bullish to Bearish in the 4th Quarter of 2021

Even with several defensive hedges in place, Vailshire Partners LP hedge fund continued to commiserate with material declines in equities, bitcoin, and related risk-on assets. These declines, if you’ll recall, started all the way back in November of 2021.

Some traditional hedges, such as long-dated US Treasuries, have failed miserably in counterbalancing equity losses. It is not surprising that minimal market bids for said Treasuries can be found from buyers around the world.

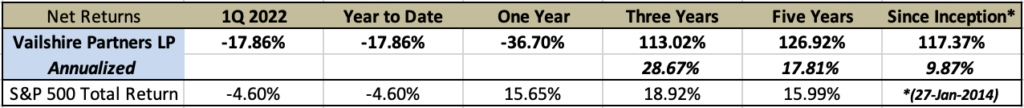

As the market continues to grind lower, it offers disappointing short-term returns but tantalizing long-term buying opportunities. For the first quarter of 2022, Vailshire Partners LP holdings returned -17.86%, compared with -4.60% for the S&P 500.

While underperformance over the past several months is disappointing, our annualized returns over the past three- and five-years–measuring +28.67% and +17.81%, respectively–continue to outperform the S&P 500 by a healthy margin (+18.92% and +15.99%, respectively).

As always, Vailshire Partners LP will maintain a patient, long-term focus, using such short-term periods of underperformance as an opportunity to load up on pristine assets while they are on sale.

Current Market Conditions

In the United States, real economic growth clearly peaked in the 4th quarter of 2021. In addition, year-over-year growth comparisons are getting more difficult at an unfortunate time. As the market pieces together this difficult combination, valuations of most businesses may continue to decline.

This morning, the March CPI print was announced. At 8.5% (per the government’s “official” measurement), inflation is at 40-year highs. This is not a milestone worth celebrating.

Higher inflation means higher-than-ever costs of goods and, related, decreased standards of living. People can tolerate such conditions for only so long before bickering, theft, and wars become more commonplace.

For what it’s worth, I am guessing that March is at or very near the 2022 high for inflation. Going forward, I expect mild disinflation to come into play as demand destruction inevitably follows these deleterious high prices.

Why does this matter?

Historically, risk-on assets do not perform well when real economic growth and inflation are simultaneously decelerating. Add to this the fact that the Federal Reserve is very much hawkish and determined to drive down inflation… and we have a recipe for a very poor performance of risk-on assets.

At some point in the coming 1-3 months I expect equities and other risk-on assets to find a bottom before recovering into the summer months. As such, it is wise to start hunting for great businesses trading at relative bargain prices. Loading up on these assets should provide the foundation for inflation-resistant, market-beating returns over the coming tumultuous decade.

2Q 2022 Investment Strategy

From Growth to Protection Mindset

From Growth to Protection Mindset

As I alluded to in the previous quarterly memo, I have used the current bearish economic and market conditions to reconfigure Vailshire Partners LP into a more inflation-resistant, tax efficient, and long-term focused fund.

The fund now consists of three primary components:

- “Hold Forever” assets

- Momentum trades

- Short-term hedges

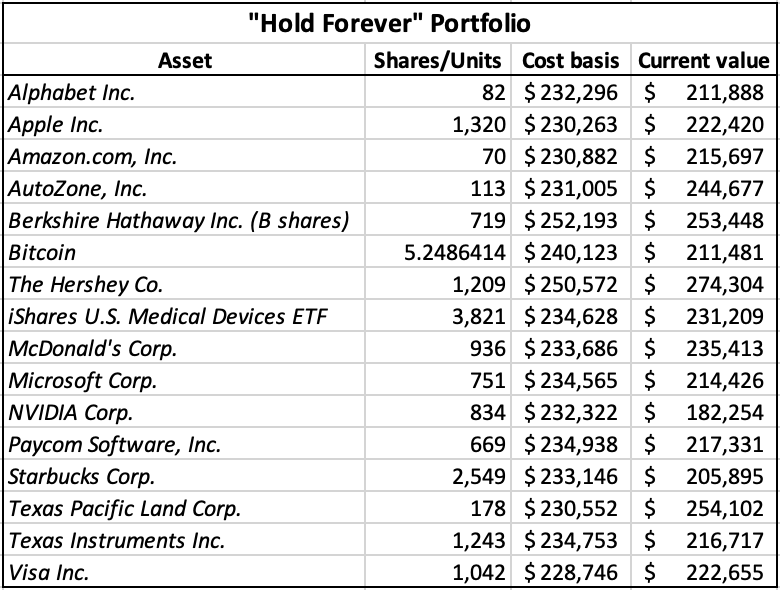

The “Hold Forever” portfolio of assets (see table above) are a collection of assets that even Warren Buffett would be proud of (accept, of course, for bitcoin). The plan is to hold these inflation-resistant, world-improving, capital-efficient assets for many decades, at a minimum. Doing so (not selling) should simultaneously improve the fund’s tax-efficiency and provide market-beating returns over time horizons of 5+ years.

My goal is to slowly and methodically acquire an increasing number of shares or units of these high quality assets, so as to own an ever-growing piece of the asset’s future profits and/or gains. Accomplishing this will require much patience and conviction, as well as the ability and means to purchase more on an ongoing basis.

Because of this, I will be encouraging current and new investors to add capital to the fund during periods of exceptional opportunity for long-term profits… such as we are currently witnessing. Putting new money to work at low points for the fund is the easiest way to significantly outperform the market over the long-term. Doing so, however, obviously requires available capital and strength of conviction!

Regarding bitcoin, we have already initiated a unique dollar cost-averaging (DCA) strategy into the fund–purchasing an additional 0.1% of the fund’s total value each week. I continue to believe that simply buying and holding bitcoin is the greatest asymmetric opportunity in all of finance. We don’t want to miss it.

Next are Vailshire Partners LP’s “momentum trades.” These are assets with explosive upside potential, which can greatly increase the overall returns of the fund. However, given their high levels of volatility, we only want to own them when they are clearly in bullish formation from a momentum perspective.

Given the current bearish market conditions, we are currently only long three (of 16) such “momentum trades” within our portfolio: $MELI, $TSLA, and ETHUSD. If the general market continues to decline, we will stop out of these holdings to protect against further downside losses.

If the market defies bearish expectations and begins to surge anew, we have 13 additional “momentum trade” assets waiting on the sidelines. Believe me… no one is more excited than I am to see the next bull market, which should be extremely profitable for us, given our ready collection of high-performance assets!

Finally, we are almost fully allocated to a collection of short-term hedges within the portfolio. These assets provide downside protection when the markets drop, and include short equity ETFs and a larger-than-normal cash allocation.

Despite the continued weak performance across the markets, in general, and Vailshire Partners, specifically, we are adapting and tangibly increasing our future prospects.

As I wrote above, I will occasionally call on current and potential new limited partners (LPs) to put new capital to work when many of our holdings have been beaten down to “bargain bin” sale prices…. I believe we are at such a time!

If you have new or additional money to put to work, I think now is a great time to do so, as fantastic assets are trading at very reasonable prices. With our focus on the long-term, our prospects for market-beating returns continue to look exceptional… especially if we are able to bolster our high quality positions.

For current non-clients: If you would like to discuss what Vailshire’s innovative investment strategies can do for you and your family, please do not hesitate to reach out to me personally via email. This is not a solicitation to invest but, rather, an invitation to inquire more.

Living well and investing wisely with you,

Jeff Ross

P.S. I was recently featured on a Bitcoin Macroeconomic Landscape panel at the Bitcoin 2022 conference in Miami. Other speakers included Jeff Booth, Preston Pysh, Mark Moss, and Trey Lockerbie (moderator). I hope you enjoy it!

In addition, I was honored to join Will Clemente III as a guest recently on the Blockware Intelligence podcast. Feel free to watch it using this link.