Happy Autumn!

The leaves are just starting to change color here in the Springs and the weather remains beautiful. It’s hard to find anything to complain about.

The leaves are just starting to change color here in the Springs and the weather remains beautiful. It’s hard to find anything to complain about.

I hope each of you is doing well.

Current Market Conditions

Inflation continues to remain frustratingly high and is even accelerating… it looks less and less “transitory” by the day. This has specific impacts upon the direction of interest rates, currencies, commodities, bonds, stocks, and even bitcoin.

In addition to inflation, GDP has recently reversed course and is now (barely) accelerating into the fourth quarter. The combination of rising inflation and GDP both impact the decisions I make for my Vailshire clients as well as the performance of our portfolios.

The Covid Delta variant appears to be peaking in multiple states, which is good news for everyone, whether vaccinated or not. While many hospital ICUs are at peak (or overflowing) capacity, I think the situation will go from bad to less bad in the coming months. Time will tell.

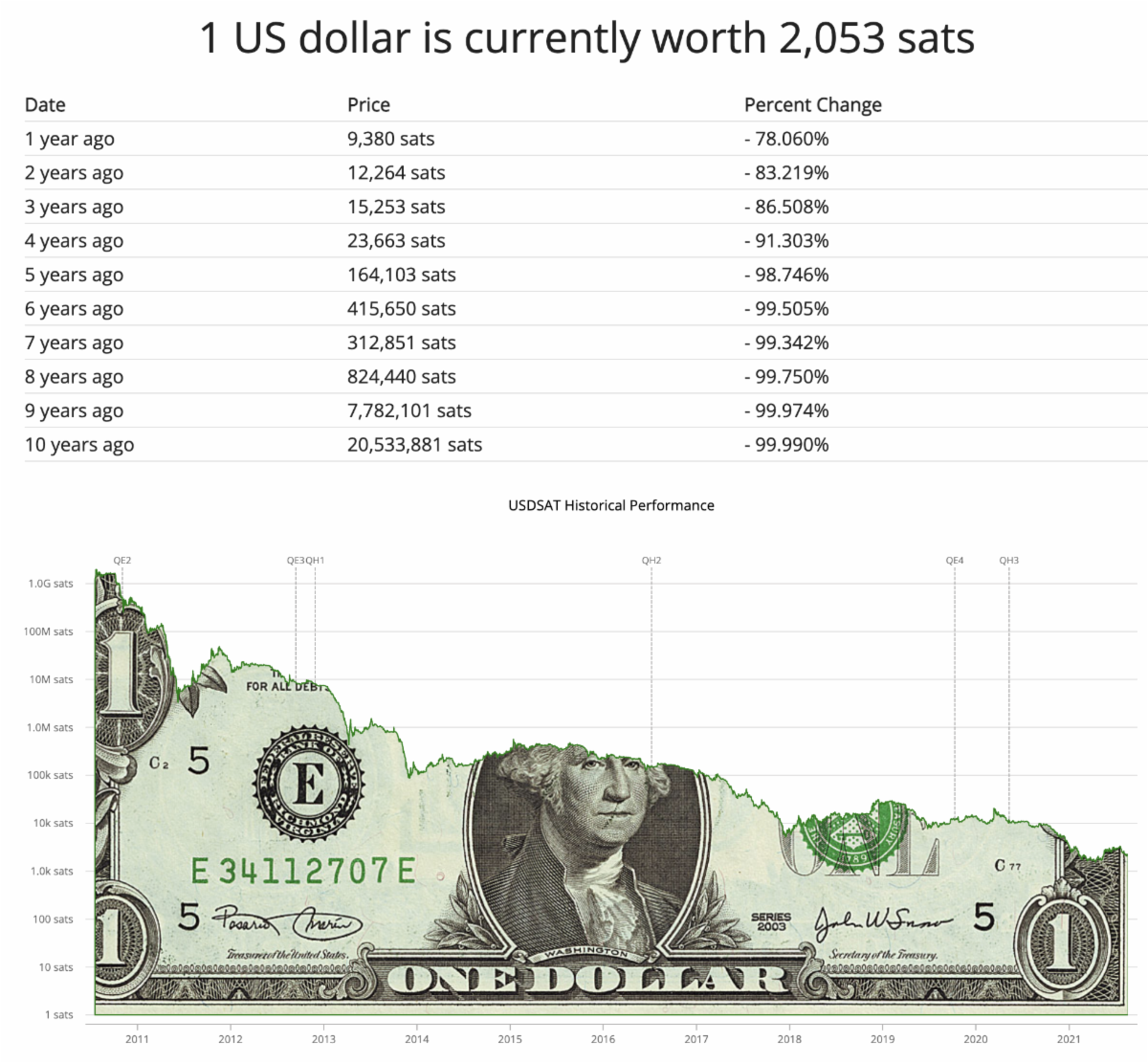

Finally bitcoin, for its part, continues doing what it was designed to do (see chart above; source: usdsat.com). That is, as the US dollar (and all fiat currencies) continue to decrease in value over time, bitcoin does the opposite: it increases in value over the long-run.

As I like to tell my 21,000+ Twitter followers on a regular basis:

The longer you save in cash, the more expensive life gets.

The longer you save in Bitcoin, the cheaper life gets.

Strategies for Vailshire’s Separately Managed Accounts

Given the above-mentioned accelerating GDP and inflation metrics, we are back to full “risk-on” mode within our Vailshire portfolios. This means that we are leaning aggressive in our stock, real estate, bitcoin, and related positions for the foreseeable future.

Technology, energy, financial, and small cap US equities should do well, as should most commodities. Bitcoin and related assets should do even better.

Depending on your financial objectives and individual account investment privileges, Vailshire’s separately managed accounts are currently allocated in the following manner:

- 20-45% US stocks (large, mid, and small caps, including technology stocks)\

- 10% emerging market stocks

- 10% real estate equities

- 5% cash

- 25-50% bitcoin, ethereum and/or related proxies (based on personal preference and trading permissions)

- 5% commodity-based equities

If you are a Vailshire Client, feel free to log into your Vailshire-managed account(s) at Interactive Brokers and see how your own portfolios are positioned. (It’s a good idea to log into your accounts at least quarterly, just to make sure your settings and demographics are up to date.)

Vailshire in the News!

I was honored to be interviewed by my friend and legendary trader, Peter Brandt, on RealVision recently. During the (approximately 50 minute) interview, we discuss my journey from being a physician to founding Vailshire Capital Management LLC, as well as my thoughts on Bitcoin, macroeconomics, and current actionable investment ideas. If these things interest you, here is a link.

If you watch the interview, I’d love to hear your thoughts. Just send me an email!

Conclusion

After a painful September for both stocks and bitcoin prices, the 4th quarter of 2021 is setting up to be something special. Given the improving underlying economic indicators, we are taking an aggressive stance within our Vailshire portfolios. I am expecting very pleasant returns.

Once again, we are striving to “make hay while the sun shines!”

Although I can’t predict the future, I am particularly excited about the coming months for our portfolios and I hope you are as well.