Dear client or friend of Vailshire Partners LP,

Greetings from Colorado Springs! I hope this quarterly memo finds you well.

The State of the Economy

The health of the President, his administration, and the economy are at the forefront of our nation’s mind as we approach election Tuesday in early November. As uncertainty about election results and coronavirus containment/immunity persist, so does market volatility.

September and October are historically difficult (read: down) months for US equities and Bitcoin during election years, and this has again proven true in 2020.

Thankfully, the historical returns for both equities and Bitcoin once presidential election results are known are generally quite positive… sometimes surprisingly so! And for this, we are positioning Vailshire Partners LP accordingly.

For now, a Congressionally-approved fiscal stimulus looks increasingly unlikely, given the partisan bickering and game theory. My opinion is that if additional money is to be printed out of thin air, then the least our government can do is put it directly in the hands of Americans, many of whom are suffering greatly from the Covid-related business closures and Depression-level increased unemployment.

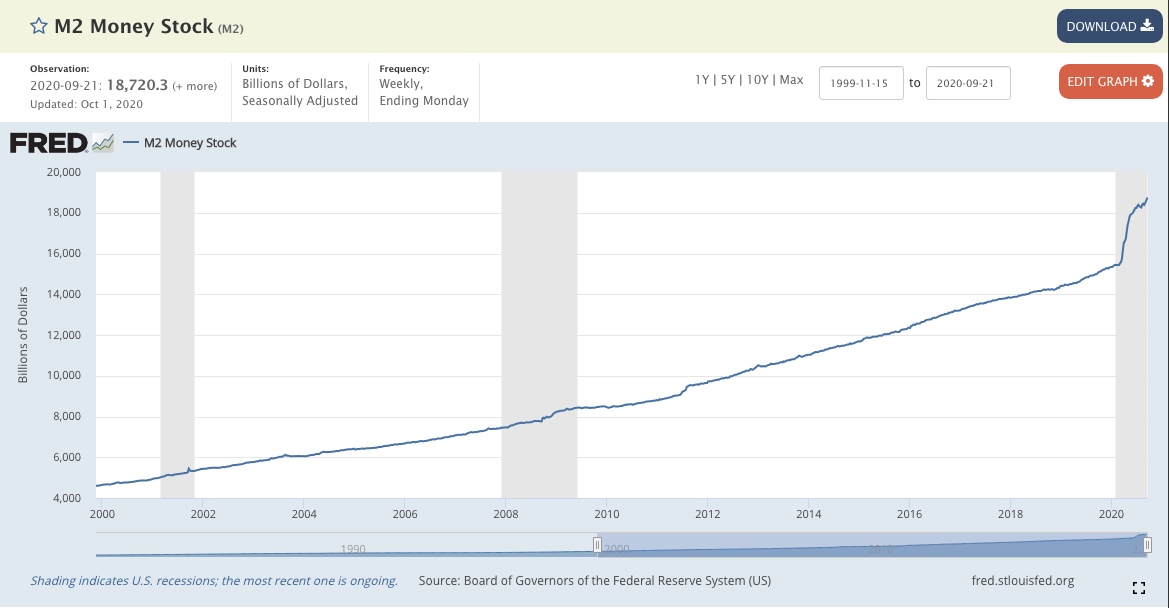

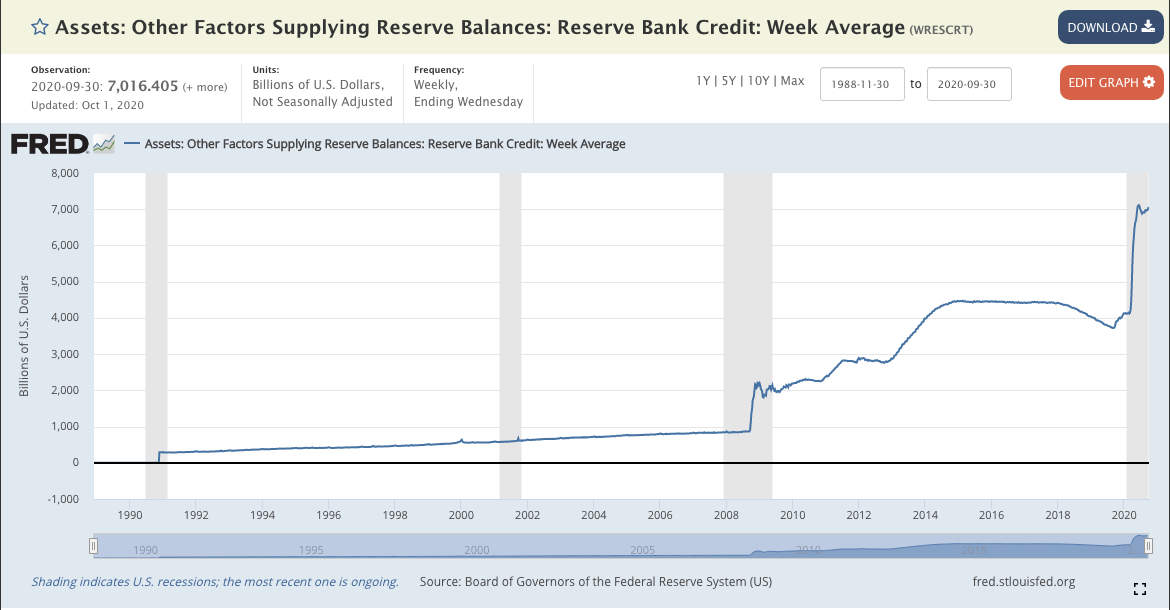

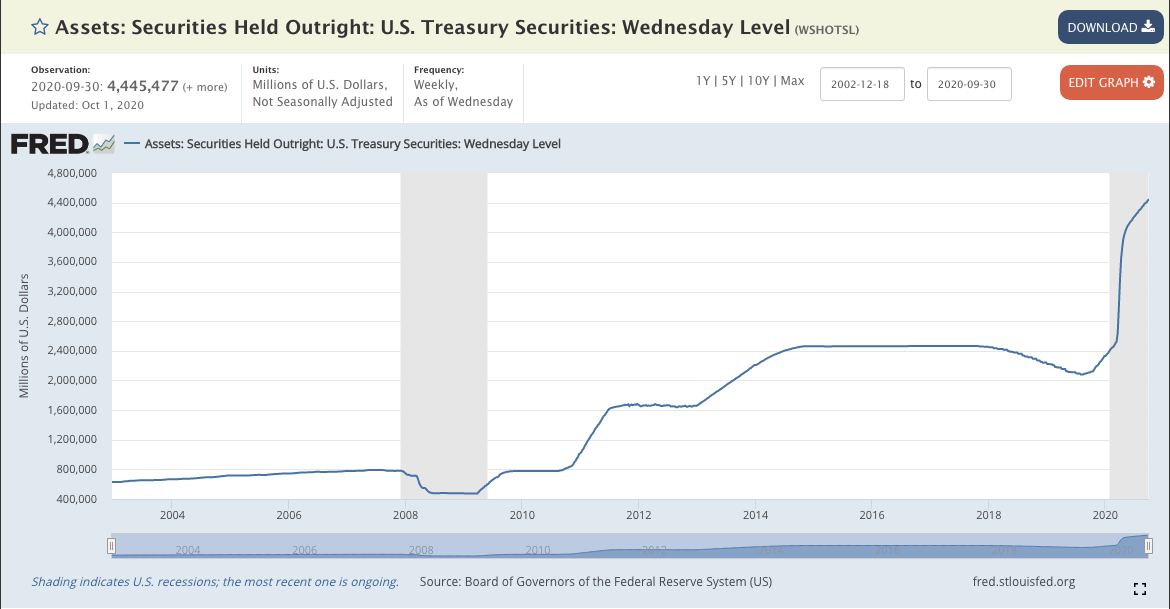

The Federal Reserve continues to “do its part” by maintaining ever-increasing supplies of money and securities (such as US Treasuries and other fixed income ETFs), as shown by the following charts:

M2 Money Stock (as of 21-September-2020)

Federal Reserve Bank Credit (as of 1-October-2020)

Federal Reserve: US Treasury Securities Held Outright (as of 1-October-2020)

Where Congressional fiscal policy is lacking, the Fed’s monetary policy is undeniably trying hard to pick up the slack!

Tumultuous times call for deft asset allocation and management. With this in mind, let’s see how Vailshire Partners LP has performed in 2020 relative to its peers.

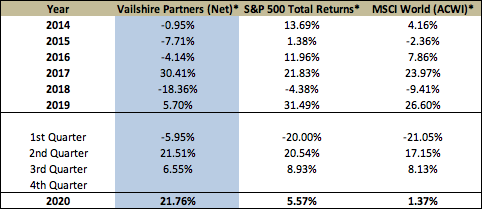

Vailshire Partners LP Annual and Quarterly Performance

*(Starting date: 27-January-2014)

As the chart reveals, through 30-September-2020, Vailshire Partners LP returned +6.55% in the 2nd quarter of 2020 and +21.76% year-to-date (YTD). This compares to a total (dividends included) YTD performance of +5.57% for the S&P 500 and +1.37% for the MSCI World Index.

Outlook for the Remainder of 2020

Throughout late 2019 and early 2020, I mentioned that this year and coming decade may be truly disappointing for traditional stock/bond portfolios, relative to the past several decades. This is primarily because of massively stretched valuations of most stocks and bonds as a response to seemingly unending quantitative easing efforts (and similar actions) by the Federal Reserve.

The downside of these ongoing “stimulus” efforts–which are occuring on an enormous scale–is the inevitable devaluation of the US dollar. I won’t bore you with details, but this currency depreciation portends to massive investment implications in the 2020s.

As I wrote at the beginning of 2020, I believe that the following asset classes will perform accordingly over the coming 5-10 years (1: Best performance; 9: Worst performance):

1. Bitcoin (and related cryptocurrencies)

2. Gold miners/royalties/streamers

3. Gold/silver bullion

4. Commodities

5. Real estate

6. Emerging market stocks

7. US stocks

8. US Treasuries

9. Cash

Note: While I am not foolish enough to suggest that this will be the exact order of asset performance, I am confident that it will be generally true. And if I am even partially correct, then you can see why the traditional 60/40 portfolio of stocks and bonds will likely perform poorly in the coming years.

The following chart (constructed on Seeking Alpha), depicts the 2020 YTD performance of gold (GLD), Bitcoin (GBTC), Housing (ITB), and the S&P 500 (SPY):

As you can see, the YTD performance of some of Vailshire’s preferred “alternative assets” versus the S&P 500 in 2020 are:

1. Real estate (ITB): 28%

2. Gold (GLD): 20%

3. Bitcoin (GBTC): 9%

4. S&P 500 (SPY): 5%

This graphic helps explain the outperformance of our portfolio relative to traditional US stocks so far in 2020 which, according to my research, will continue to trend in our favor over the coming years.

Vailshire Partners LP continues to invest heavily in the above-mentioned assets, with an emphasis on innovative technology and healthcare companies. Short positions have recently been increased in response to current underlying market conditions, including decelerating GDP and inflation. As the underlying economic and inflation conditions change, so too will our long and short portfolio exposures.

In Conclusion

Geopolitical uncertainty is the flavor du jour. And associated market volatility should continue until presidential election results are made clear. Don’t be surprised by this and get tempted to sell and “cash out” market drawdowns inevitably occur.

Rather, wise investors (like us) should plan ahead to take advantage of temporary market declines and invest new money when the majority of market participants are in panic mode.

If you have cash sitting on the sidelines, I would encourage current and future limited partners (LPs) to get invested while the path looks uncertain… as it does today. Doing so can significantly increase long-term investment gains.

Beyond the current darkness is the potential for generational wealth creation from several of our “alternative” portfolio holdings. And my desire is for all Vailshire clients to greatly profit alongside my own savings within the fund.

As always, if you have any questions or comments, feel free to reply to this email or give me a call.

I am continually honored by the trust you have placed in me.

Living well and investing wisely with you,

Jeff