Dear client or friend of Vailshire Partners LP,

Greetings from Colorado Springs!

Much has happened in the world since my last quarterly memo, so I’ll just dig right into it.

The State of the Economy

Unemployment numbers in the United States are still at near-record high levels, but continue to decline at a steady rate, which is encouraging. Manufacturing numbers have strongly rebounded. Even the service industry, which is taking the brunt of the coronavirus shutdown effects, is showing signs of life from its recent bottom.

The Treasury and Federal Reserve (“the Fed”), for their part, are doing everything in their power to “paper over” the economic depression. And so far, it appears to be working.

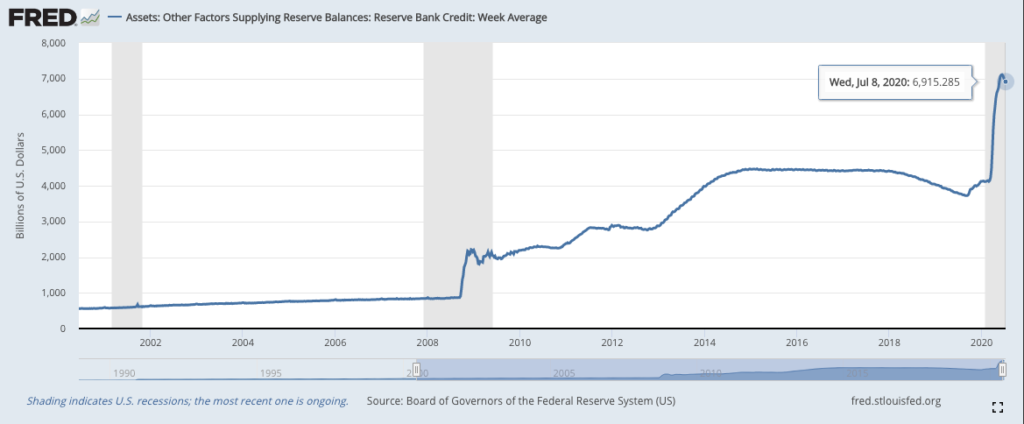

To comprehend the magnitude of the Fed’s efforts, consider the following graph:

In simple language, the above chart shows the current assets on the Federal Reserve’s balance sheet. You may notice that it spiked higher in 2009 as a (previously unprecedented) response to the global financial crisis.

The recent spike in assets, however, puts any prior additions to shame. Stock market participants tend to notice such actions, which have coincided with memorable March lows of both 2009 and 2020.

It remains to be seen whether or not the US equity market will continue its ascent while underlying economic fundamentals remain quite fragile. Some companies have faltered during these trying times, while others have proved to be resilient.

Thankfully, at Vailshire, we are constantly on the search for assets to buy both within and outside of the realm of US stocks and bonds. When we apply our systematic investment approach, we see that opportunities abound… and this has been reflected in the performance of Vailshire Partners LP, to date.

Vailshire Partners LP Annual and Quarterly Performance

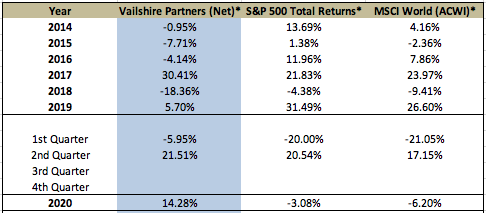

As the chart reveals, Vailshire Partners LP returned +21.51% in the 2nd quarter of 2020 and +14.28% year-to-date (YTD). This compares to a total (dividends included) YTD performance of -3.08% for the S&P 500 and -6.20% for the MSCI World Index.

Outlook for the Remainder of 2020

In the increasingly competitive world of asset management, I am compelled to hold the “secret sauce” of Vailshire Partners’ outlook and asset allocation a little closer to my vest.

I strongly believe that the 2020s will be one of relatively poor performance for traditional stock and bond index investors. Conversely, superior returns will be achieved via a systematic, full-cycle investment approach that considers significant allocations to “alternative” assets; namely, investable asset classes outside of US stock and bond indexes.

In light of this, our portfolio will remain long of positions that have a history of outperformance in particular economic conditions, while shorting positions that statistically underperform.

Our portfolio currently consists of select US and international equities, exchange-traded real estate opportunities, precious metals equities, Bitcoin and cryptocurrencies, commodities, and several short positions.

In Conclusion

Despite historically appalling economic fundamentals, many lucrative investments can be found both within and outside of traditional investable asset classes.

At Vailshire, we are very well-positioned for the ongoing volatility, geopolitical tensions, and persistent macroeconomic uncertainty. To be completely honest, I have not been this optimistic about our portfolio holdings at any point during my tenure as Vailshire Partners’ fund manager.

As an aside, I am thankful for the limited partners who have added capital to Vailshire Partners during 2020. I realize it can be daunting to pull extra cash out of “safe” savings accounts and put it to work as an investment during such tumultuous times. This long-term perspective of my co-investors is a true competitive advantage in today’s myopic world.

I am honored by the trust you have placed in me.

As always, if you have any questions or comments, feel free to reply to this email or give me a call.

Investing wisely and optimistically with you,

Jeff