To Separately Managed Account Clients of Vailshire Capital Management:

Spring has finally sprung here in Colorado Springs! I hope each of you is doing well and enjoying the Easter weekend.

Current Market Conditions

Not much has changed since our last monthly update, other than increasing optimism within the financial markets, as we predicted.

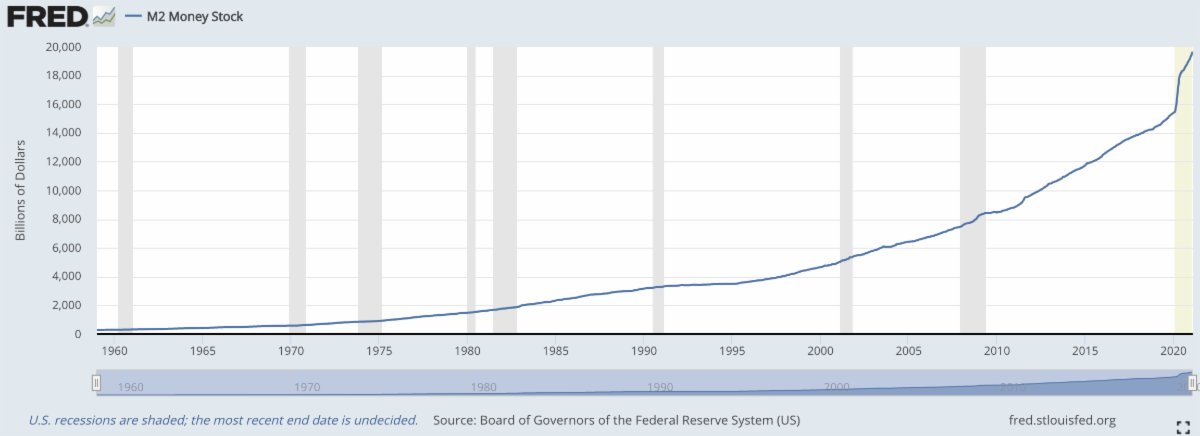

In the United States’ and most of the world’s major economies, inflation and GDP have been accelerating throughout 1Q 2021, and should continue doing so even more in 2Q 2021. The Federal Reserve and other major central banks remain extremely accommodative, with artificially low short-term interest rates and historically massive increases in the M2 money stock (see chart above).

Covid fear is slowly (too slowly?) resolving as vaccine distribution accelerates personal/societal immunity throughout the US and around the world. Strongly related pent-up consumer demand bodes well for businesses resuming more “normal” operations in the coming months, with expected increases in revenues and earnings. I expect glowing reports from companies in the near future.

For the coming 1-3 months, I expect the attitude of market participants to change from cautiously optimistic to extremely optimistic. Given the aggressive positioning of our “risk on” portfolios, I anticipate that we will continue to perform extremely well over this period of time.

Strategies for Vailshire’s Separately Managed Accounts

Similar to the last several months, I continue to believe that now is the time to be aggressively positioned for significant investment profits.

This means, as in prior months, adding new cash to our accounts where applicable and being almost fully invested (very low cash positions) across our Vailshire portfolios.

Depending on your financial objectives and individual account investment privileges, Vailshire’s separately managed accounts are currently allocated in the following manner:

- 40-45% US stocks (large, mid, and small caps, including technology and energy stocks)

- 10% Emerging market stocks

- 5-10% Cash

- 30-40% Bitcoin, Ethereum and/or Cryptocurrency proxies (based on personal preference and trading permissions)

- 5% Commodity-based equities

If you are a Vailshire Client, feel free to log into your Vailshire-managed account(s) at Interactive Brokers and see how your own portfolios are positioned. (It’s a good idea to log into your accounts at least quarterly, just to make sure your settings and demographics are up to date.)

Vailshire in the News

I was honored to be interviewed by Ed Gotham recently on the Opto Sessions podcast as well as by José Iván García and Michael Morosi of ZonaValue TV.

Feel free to check out the interviews and let me know what you think. If you like them, please pass them on to your friends and family.

Conclusion

Vailshire’s separately managed accounts continue to perform extremely well relative to traditional stock/bond portfolios.

Barring an unforeseen “black swan” event in the coming months, I anticipate that our aggressive positioning will serve us quite well, to put it mildly. As I have stated for several months, I continue to believe that investors should make hay while the sun shines… and the sun continues to shine upon us!

I continue to be humbled and grateful for the trust you have placed in me and Vailshire’s innovative portfolio management solutions.

Living well and investing wisely with you,

Jeff Ross, MD, MBA